The recent decision of Morningstar to remove the ‘sustainable’ investment label from more than 1,200 European funds brought a significant challenge of ESG investing under the spotlight: many funds cannot meet customers’ expectations of making a positive impact on the environment and society. While there are many reasons why, we want to focus on a key factor; impact measurement.

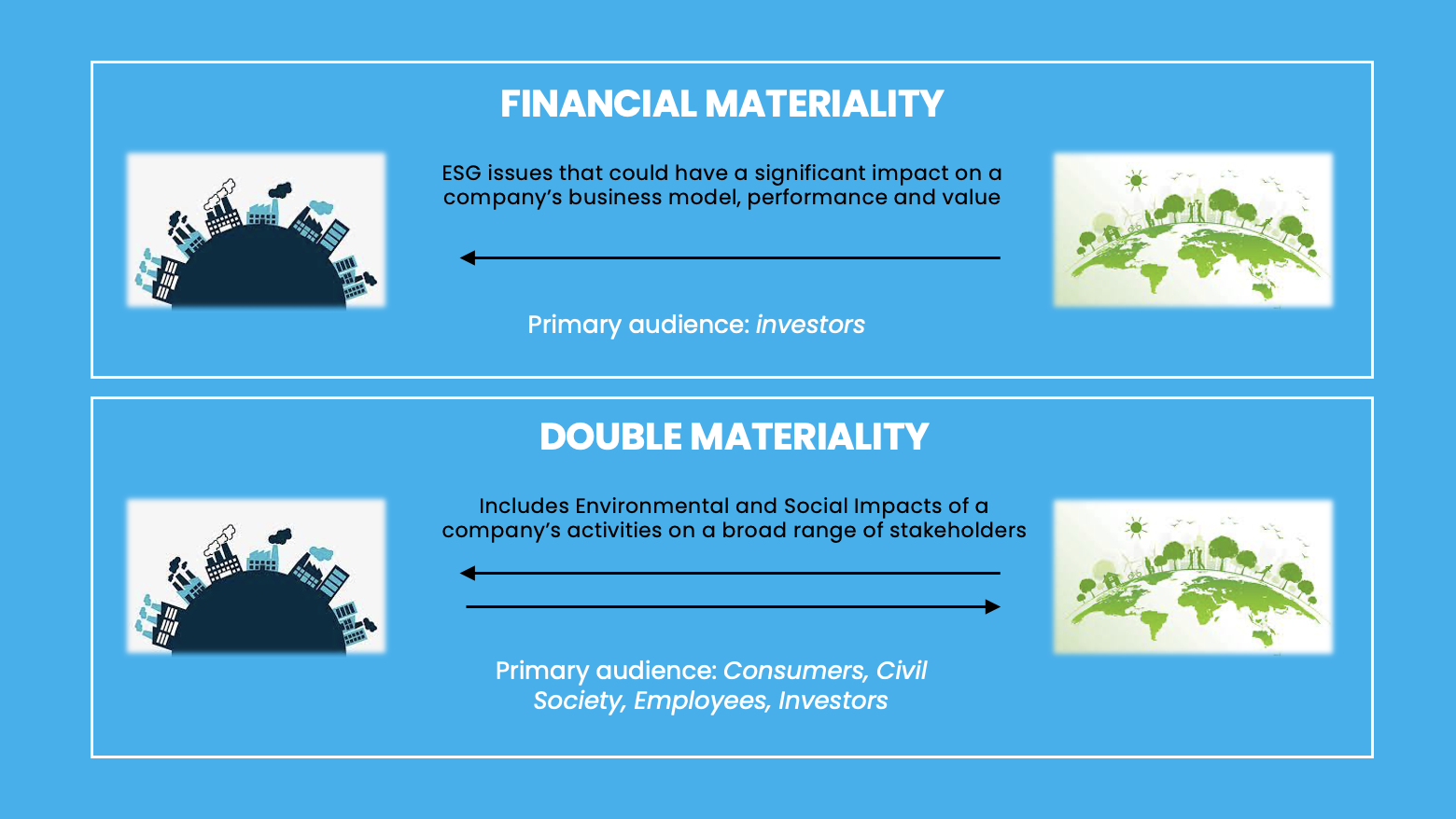

For investors, the most important consideration when looking into ESG data has naturally been the impact of ESG issues on company value; financial materiality. ESG data providers responded to that demand by offering ESG data, scores and ratings focused on the issues relevant for a company given its sector and how its management is responding to those issues. Input type metrics such as the existence of policies and intentions in the form of future targets became important for risk management, together with insights on a company’s performance relative to its peers.

But is this what a client is asking for when they look for investments with positive impact? How is the existence of a policy ensuring that a company actively promotes environmental and/or social characteristics? Should a comparison with industry peers matter if the whole industry is doing significant harm to the environment? As one of our senior advisors rightly put it ‘how can we have top ‘performers’ in terms of deforestation practices while forests keep disappearing?’

As much as financial materiality is crucial, an understanding of the real impact a company has on the environment and the society is paramount. The concept of ‘double-materiality’ was first formally proposed by the European Commission, encouraging a company to judge materiality from these two perspectives.[1] It is not just climate-related impacts on the company that can be material but also impacts of a company to the climate, or any other dimension of ESG, for that matter.

At RGS, measuring the real impact of a company on the environment and the society has been our focus from day one. We built our impact models utilizing only outcome metrics rather than inputs or intentions, prioritizing absolute impact rather than a relative performance against peers and aiming to eliminate opportunities for greenwashing.

Regulatory frameworks, like SFDR, are also pushing the market towards a similar direction. It won’t be long until further scrutiny is placed on funds labelled as article 8 or 9 that mostly follow a revenue mapping exercise rather than an assessment of real impact at the ESG metric level. Scoring better than your competitors does not mean that you have a positive impact, it only means you do less harm.

If you do want to understand the real impact of your investments feel free to reach out.

[1] https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52019XC0620(01)